Executive Condo Overview

Explore the key features and advantages of owning an executive condominium, including proximity to amenities, modern facilities, and investment potential for both families and professionals.

Discover the Benefits of Executive Condos

🎯 Key Benefits of Buying an EC in 2025

✅ No Need to Sell Your HDB Immediately

You can retain your existing HDB flat while waiting for your EC to be completed — giving you ample time to plan your move and avoid interim housing costs.

✅ Up to $30,000 CPF Housing Grants

First-time buyers enjoy CPF Housing Grants of up to $30,000, which reduce your purchase cost significantly.

✅ No Ethnic Quota Restrictions After MOP

Once the EC reaches its Minimum Occupation Period (MOP) of 5 years, the Ethnic Integration Policy (EIP) no longer applies — allowing you to sell to a wider pool of buyers.

✅ High Capital Appreciation Potential

Many ECs have shown profits of $200K to over $1 million after reaching MOP and full privatisation (after 10 years).

✅ Generally More Spacious Than Private Condos

ECs often feature larger unit sizes, utility rooms, and clear separation of living/dining areas — ideal for growing families.

✅ Full Condo Facilities

Enjoy modern amenities like swimming pools, BBQ pits, gyms, tennis courts, and function rooms within a gated community.

✅ Strategic Locations

Most ECs are located in mature or upcoming estates with proximity to schools, malls, MRT stations, and expressways — ensuring both convenience and future growth.

✅ Lower Entry Price Compared to Private Condos

ECs are typically priced 15–30% lower than nearby private condominiums, offering excellent value with similar lifestyle benefits.

✅ Deferred Payment Scheme Available

Eligible buyers can defer their loan repayment until completion, giving more flexibility in financial planning.

✅ Exclusively for Eligible Singaporeans

ECs are reserved for Singaporean households during the initial launch phase, with eligibility requiring the main applicant to be a Singapore Citizen and at least one other applicant to be a Singapore Citizen or Permanent Resident.

This exclusivity encourages a predominantly owner-occupied environment, fostering stronger community bonds and a more family-friendly atmosphere.

✅ Automatic Privatisation After 10 Years

Once fully privatised, ECs can be sold to foreigners — potentially increasing buyer demand and resale value.

✅ No Additional Buyer’s Stamp Duty (ABSD)

Even if you currently own an HDB flat, you don’t need to pay ABSD when purchasing a new EC under the HDB upgraders’ rule — as long as you sell your flat within 6 months of receiving keys.

✅ No Second Home Loan Restrictions

Unlike private properties, ECs are not considered a second property during the construction phase — so you won’t be subject to loan restrictions typically applied to second home buyers.

✅ Special Bridging Loan for HDB Upgraders

Eligible buyers can enjoy a Special Bridging Loan paired with the Deferred Payment Scheme, allowing you to:

- Secure your new EC without selling your HDB first

- Defer major payments until the EC is ready (TOP)

- Use proceeds from your HDB sale later to settle the bridging loan

This option helps you upgrade smoothly without cash flow stress or urgent timelines.

💡 Summary

Executive Condominiums offer an unparalleled opportunity to own a private-style home with public housing privileges. With high appreciation potential, strong locations, and government incentives, ECs remain one of the most affordable and rewarding property options for Singaporeans.

📲 Want to find out which EC you qualify for or get started with a financial assessment?

👉 Click here to connect with me on WhatsApp.

🔥 Record Profits from EC Resales in 2024 – What You Should Know

💰 More EC Owners Are Cashing Out with $1M+ Gains

In 2024, 38 Executive Condominium (EC) units were resold with profits exceeding $1 million – more than double the 15 such transactions in 2023.

This milestone reflects the growing value of ECs, especially in prime locations with MRT access and reputable schools.

📊 Quick Facts:

✅ Highest Recorded Profit:

Bishan Loft – resale unit earned a $2.63 million profit

✅ Popular Profitable ECs:

- Hundred Palms Residences

- The Rainforest

- Esparina Residences

- The Vales

- Citylife @ Tampines

✅ Why the Big Gains?

- Rising private home prices

- ECs bought during 2004–2008 at lower prices

- Upgrades to private condos now more common

- Strong locations (e.g., near MRT or top schools)

💼 Expert Insights:

“The hybrid nature of ECs – priced like public housing but with condo-like facilities – makes them highly attractive to both homeowners and investors.”

— Christine Sun, Senior Researcher, OrangeTee

With EC prices climbing, buyers are eager to own one before reaching private property prices. At the same time, owners are seizing this opportunity to upgrade to larger homes or cash out with gains.

🏗️ What’s Hot in 2025?

🔹 Aurelle EC – East Side’s Star Executive Condo

If you’re looking for an affordable entry into condo living, the newly launched Aurelle EC in Tampines North is drawing strong demand.

- 💡 Over 5,000 visitors attended its showflat preview in February 2025

- 💰 Indicative 3-bedroom price: From $1.47M (approx. $1,687 psf)

- 📍 Strong location near amenities, schools, and Tampines North MRT (upcoming)

This hybrid public-private EC offers condo-like facilities with a more accessible price point — making it attractive for young families and upgraders.

🔹 Parktown Residences – Sold Over 87% at Launch, But Not an EC

Often mistaken as an EC, Parktown Residences is actually a private integrated condominium. Located nearby, it launched earlier in 2025 and made headlines for its overwhelming response:

- 🏢 Integrated development with direct access to MRT, mall, bus interchange, hawker centre, and community club

- 💰 3-bedroom prices: From approx. $2.07M (about $2,235 psf)

- 📈 87% of its 1,193 units sold during launch at a median price of $2,360 psf

While more premium than ECs, Parktown’s appeal lies in its convenience and potential long-term growth.

💬 Which Should You Choose?

✅ Aurelle EC

Best for: First-timers, young couples, HDB upgraders

Why: Lower entry price, full condo facilities, eligibility for CPF grants

✅ Parktown Residences

Best for: Investors and families looking for seamless lifestyle connectivity

Why: Integrated transport, mall, and amenities within the development

🎯 Get Advice Tailored to You

📲 Click here to get FREE guidance & check your eligibility for ECs or condos

📌 Key Takeaway

If you’re a current EC owner, this could be the right time to explore your resale options. And if you’re a buyer — securing an EC now could mean strong future capital appreciation.

👇 Want to Check Your EC’s Value?

📲 Click here to get a FREE indicative valuation & explore your options

| Project Name | Units Availability | Date Tender Awarded | 15-Months Wait Out | Street Name | Successful Tenderer’s Name | Max. Gross Floor Area (Sq Ft) | Tender Price | $ PSF PPR |

| —— | — | 08 / 11 / 2024 | 08 / 02 / 2026 | Tampines Street 95 | Sim Lian Land Pte Ltd and Sim Lian Development Pte Ltd | 605,184.37 | $465,000,000.00 | $768.36 |

| —— | — | 16 / 08 / 2024 | 16 / 11 / 2025 | Jalan Loyang Besar | CNQC Realty (Progressive) Pte. Ltd., Forsea Residence Pte. Ltd. and ZACD Laserblue Pte. Ltd. | 764,388.33 | $557,000,000.00 | $728.69 |

| OTTO PLACE | 236 / 600 | 14 / 02 / 2024 | 14 / 05 / 2025 | Plantation Close | Hoi Hup Realty Pte Ltd and Sunway Developments Pte. Ltd. | 603,930.72 | $423,380,000.00 | $701.04 |

| AURELLE OF TAMPINES | FULLY SOLD | 09 / 10 / 2023 | 09 / 01 / 2025 | Tampines Street 62 (Parcel B) | Sim Lian Land Pte Ltd and Sim Lian Development Pte Ltd | 753,484.49 | $543,280,000.00 | $721.02 |

| NOVO PLACE | FULLY SOLD | 11 / 09 / 2023 | 11 / 12 / 2024 | Plantation Close | Hoi Hup Realty Pte Ltd and Sunway Developments Pte. Ltd. | 495,527.38 | $348,500,000.00 | $703.29 |

| LUMINA GRAND | FULLY SOLD | 28 / 09 / 2022 | 28 / 12 / 2023 | Bukit Batok West Avenue 5 | CDL Zenith Pte. Ltd. | 536,817.74 | $336,068,000.00 | $626.04 |

| ALTURA | FULLY SOLD | 22 / 03 / 2022 | 22 / 06 / 2023 | Bukit Batok West Avenue 8 | CNQC-OS (2) Pte. Ltd. and SNC Realty Pte. Ltd. | 402,010.53 | $266,000,000.00 | $661.67 |

| TENET | FULLY SOLD | 03 / 08 / 2021 | 03 / 11 / 2022 | Tampines Street 62 (Parcel A) | QJ-OS Pte. Ltd. and Santarli Realty Pte. Ltd. | 640,431.14 | $422,000,000.00 | $658.93 |

| COPEN GRAND | FULLY SOLD | 03 / 06 / 2021 | 03 / 09 / 2022 | Tengah Garden Walk | Taurus Properties SG Pte. Ltd. | 663,691.95 | $400,318,000.00 | $603.17 |

| NORTH GAIA | FULLY SOLD | 20 / 11 / 2020 | 20 / 02 / 2022 | Yishun Avenue 9 | Sing Holdings Limited | 648,417.96 | $373,500,000.00 | $576.02 |

| PARC GREENWICH | FULLY SOLD | 11 / 03 / 2020 | 11 / 06 / 2021 | Fernvale Lane | FCL Lodge Pte. Ltd. | 516,280.2 | $286,538,000.00 | $555.00 |

| PROVENCE RESIDENCE | FULLY SOLD | 11 / 10 / 2019 | 11 / 01 / 2021 | Canberra Link | MCC Land (Singapore) Pte Ltd | 413,194.23 | $233,890,000.00 | $566.05 |

| PARC CENTRAL RESIDENCES | FULLY SOLD | 22 / 01 / 2019 | 22 / 04 / 2020 | Tampines Avenue 10 | Hoi Hup Realty Pte Ltd and Sunway Developments Pte Ltd | 751,482.41 | $434,450,000.00 | $578.12 |

| OLA | FULLY SOLD | 27 / 09 / 2018 | 27 / 12 / 2019 | Anchorvale Crescent | Evia Real Estate (8) Pte Ltd & Gamuda (Singapore) Pte Ltd | 553,393.09 | $318,888,899.00 | $576.24 |

| PARC CANBERRA | FULLY SOLD | 10 / 09 / 2018 | 10 / 12 / 2019 | Canberra Link | Hoi Hup Realty Pte Ltd and Sunway Developments Pte Ltd | 485,468.51 | $271,000,000.00 | $558.22 |

| PIERMONT GRAND | FULLY SOLD | 07 / 03 / 2018 | 07 / 06 / 2019 | Sumang Walk | CDL Constellation Pte. Ltd. and TID Residential Pte. Ltd. | 873,698 | $509,370,000.00 | $583.00 |

| RIVERCOVE RESIDENCES | FULLY SOLD | 05 / 09 / 2016 | 05 / 12 / 2017 | Anchorvale Lane | Hoi Hup Realty Pte Ltd and Sunway Developments Pte Ltd | 678,597.82 | $240,950,000.00 | $355.07 |

| HUNDRED PALMS RESIDENCES | FULLY SOLD | 29 / 02 / 2016 | 29 / 05 / 2017 | Yio Chu Kang Road | Hoi Hup Realty Pte Ltd | 555,246.85 | $183,800,000.00 | $331.02 |

| iNZ RESIDENCE | FULLY SOLD | 24 / 08 / 2015 | 24 / 11 / 2016 | Choa Chu Kang Avenue 5 | Qingjian Realty (Residential) Pte. Ltd, Suntec Property Ventures Pte Ltd and Bohai Investments (Sengkang) Pte Ltd | 529,135.54 | $156,157,000.00 | $295.12 |

| NORTHWAVE | FULLY SOLD | 23 / 02 / 2015 | 23 / 05 / 2016 | Woodlands Avenue 12 | Hao Yuan Investment Pte Ltd | 373,370.34 | $103,790,000.00 | $277.98 |

| TREASURE CREST | FULLY SOLD | 05 / 02 / 2015 | 05 / 05 / 2016 | Anchorvale Crescent | Sim Lian Land Pte Ltd | 563,493.94 | $157,800,000.00 | $280.04 |

| THE VISIONAIRE | FULLY SOLD | 02 / 10 / 2014 | 02 / 01 / 2016 | Sembawang Road / Canberra Link | Qingjian Realty (Residential) Pte Ltd. | 649,778.41 | $229,377,000.00 | $353.01 |

| WANDERVALE | FULLY SOLD | 09 / 09 / 2014 | 09 / 12 / 2015 | Choa Chu Kang Drive | Sim Lian Land Pte Ltd | 574,388.09 | $207,400,000.00 | $361.08 |

| PARC LIFE | FULLY SOLD | 14 / 07 / 2014 | 14 / 10 / 2015 | Sembawang Avenue | FCL Tampines Court Pte. Ltd. & KH Capital Pte. Ltd. | 668,774.24 | $214,080,000.00 | $320.11 |

| THE CRITERION | FULLY SOLD | 26 / 05 / 2014 | 26 / 08 / 2015 | Yishun Street 51 (Parcel A) | Verwood Holdings Pte. Ltd. and TID Residential Pte. Ltd. | 540,698.78 | $178,500,000.00 | $330.13 |

| SIGNATURE AT YISHUN | FULLY SOLD | 26 / 05 / 2014 | 26 / 08 / 2015 | Yishun Street 51 (Parcel B) | JBE Holdings Pte Ltd | 550,349.27 | $184,130,000.00 | $334.57 |

| SOL ACRES | FULLY SOLD | 03 / 03 / 2014 | 03 / 06 / 2015 | Choa Chu Kang Grove (Parcel A) Choa Chu Kang Grove (Parcel B) | MCL Land (Brighton) Pte. Ltd. | 619,920.51 619,867.77 | $232,500,000.00 $210,100,000.00 | $375.05 $338.94 |

| THE VALES | FULLY SOLD | 19 / 02 / 2014 | 19 / 05 / 2015 | Anchorvale Crescent | Phoenix Real Estate Pte Ltd | 525,709.38 | $192,888,888.00 | $366.91 |

| THE BROWNSTONE | FULLY SOLD | 29 / 01 / 2014 | 29 / 04 / 2015 | Canberra Drive | Verwood Holdings Pte. Ltd. and TID Residential Pte. Ltd. | 645,632.80 | $226,000,000.00 | $350.04 |

| WESTWOOD RESIDENCES | FULLY SOLD | 14 / 01 / 2014 | 14 / 04 / 2015 | Westwood Avenue | Changi Properties Pte. Ltd. & Heeton Homes Pte. Ltd. | 520,945.71 | $198,900,000.00 | $381.81 |

| LAKE LIFE | FULLY SOLD | 02 / 08 / 2013 | 02 / 11 / 2014 | Yuan Ching Road / Tao Ching Road | Evia Real Estate (5) Pte Ltd, BBR Development Pte Ltd, CNH Investment Pte Ltd and OKP Land Pte Ltd | 651,895.78 | $272,838,888.38 | $418.53 |

| THE TERRACE | FULLY SOLD | 02 / 08 / 2013 | 02 / 11 / 2014 | Punggol Drive / Edgedale Plains | Peak Square Pte. Ltd. | 880,706.59 | $312,800,000.00 | $355.17 |

| THE AMORE | FULLY SOLD | 02 / 08 / 2013 | 02 / 11 / 2014 | Punggol Central / Edgedale Plains | Master Contract Services Pte Ltd / Keong Hong Construction Pte Ltd | 438,030.88 | $156,000,000.00 | $356.14 |

| BELLEWATERS | FULLY SOLD | 31 / 05 / 2013 | 31 / 08 / 2014 | Anchorvale Crescent | Qingjian Realty (South Pacific) Group Pte Ltd | 742,709.82 | $245,577,000.00 | $330.65 |

| BELLEWOODS | FULLY SOLD | 13 / 05 / 2013 | 13 / 08 / 2014 | Woodlands Avenue 5 / Woodlands Avenue 6 | Qingjian Realty (South Pacific) Group Pte Ltd | 633,047.53 | $216,000,000.00 | $341.21 |

The information provided in this table is for general reference only. Land sale prices, $PSF per plot ratio, and expected launch dates are based on publicly available data and industry estimates. Actual figures may vary depending on official sources, developer decisions, and market conditions. Please verify details with the respective authorities or consult a qualified real estate professional for the most accurate and up-to-date information.

📊 EC Land Sales & Launch Trends Table

This table presents comprehensive data on Executive Condominium (EC) land parcels sold by HDB, with a focus on the per plot ratio price (psf ppr) and anticipated launch timelines. It’s a useful guide to understanding how land costs and project timelines shape eventual selling prices:

🔍 Key Observations & Background

- EC land prices have consistently increased over the past decade, rising from an average of S$287 psf ppr in 2015 to about S$733 psf ppr by early 2025 — a total increase of roughly 164%

- For example, the Tengah Garden Walk (Copen Grand) EC site achieved a bid of S$603 psf ppr in 2021, while a later site at Plantation Close went for S$701 psf ppr, showing a continued upward trend in land costs.

- Due to regulatory requirements, developers must observe a mandatory wait‑out period of 15 months — or until foundation completion, whichever comes sooner — before launching an EC project for public sale. This rule encourages more prudent bidding and moderates pricing behavior.

✅ How to Use the Table

- Land Cost (psf ppr) column reflects how much developers paid, which directly influences selling price psf.

- The Launch Eligibility column notes whether the project is ready to launch (i.e. either 15 months have passed or foundation is complete).

- When launch is permitted, take note: actual unit prices typically follow land cost trends with a built-in developer margin.

- Watch the market: new projects like Aurelle EC (2025) preview EC pricing benchmarks following earlier land sales.

💡 Why This Matters to Buyers

- Higher land prices = higher launch psf — which impacts affordability.

- Delayed launches post-foundation allow developers time to plan and set pricing more strategically.

- Following trends in psf ppr gives a preview into future launch pricing for savvy buyers.

Summary:

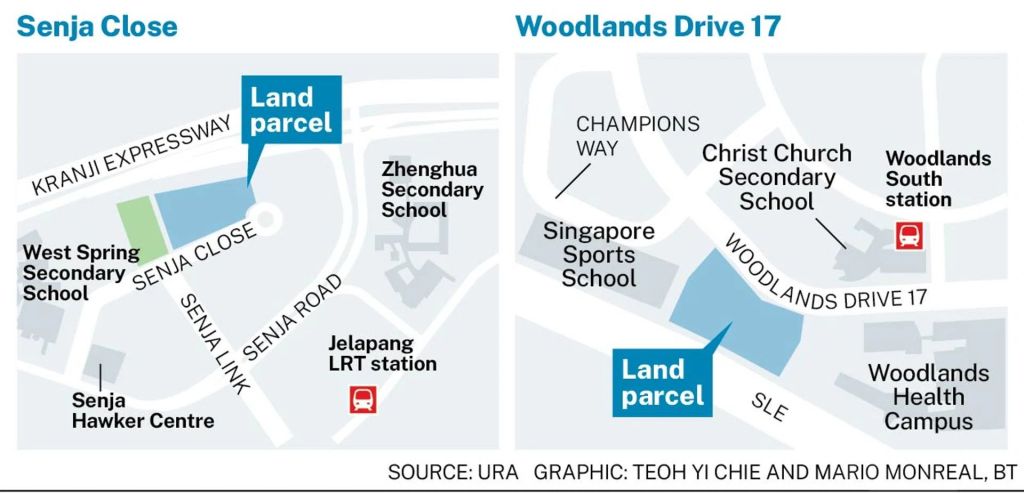

City Developments Limited (CDL) emerged as the top bidder for two executive condominium (EC) sites at Woodlands Drive 17 and Senja Close, as tenders closed on Aug 5. Both sites attracted strong interest with five bids each, and CDL’s offers set new price benchmarks.

The 420-unit Woodlands site was secured for $360.9 million ($782 psf ppr), slightly surpassing the previous record. The Senja Close site, expected to yield 295 units, was acquired for $252.9 million ($771 psf ppr).

CDL CEO Sherman Kwek highlighted the strategic importance of these acquisitions, noting they come on the heels of sell-out successes at Lumina Grand and Copen Grand, and will help replenish the group’s EC pipeline with over 700 new units.

CDL Sets New Benchmarks with Dual EC Site Wins at Woodlands and Senja Close

SINGAPORE – In a strategic move to strengthen its executive condominium (EC) pipeline, City Developments Limited (CDL) has emerged as the top bidder for two EC sites, with tenders closing on August 5. Both plots attracted strong competition with five bids each, and CDL’s successful offers have set new price benchmarks for EC land.

CDL secured the Woodlands Drive 17 site—spanning 25,207 sq m and expected to yield 420 units—with a top bid of $360.9 million ($782 psf ppr). This narrowly edged out the second-highest bid from Sim Lian Land and Sim Lian Development at $781 psf ppr, by just $1 psf ppr or 0.2%. Other contenders included Intrepid Investments and TID Residential ($770 psf ppr), Hoi Hup Realty and Sunway Developments ($763 psf ppr), and EL Development ($711 psf ppr). Analysts had projected bids to range from $700 to $770 psf ppr.

This Woodlands parcel is located next to the Singapore Sports School and has a maximum gross floor area (GFA) of 42,853 sq m. It is the first EC site awarded in the area since 2015, when Hao Yuan Investment won the Northwave site at $278 psf ppr. Northwave was launched in 2016 and has since seen a median sale price of $779 psf.

At Senja Close in Bukit Panjang, CDL’s winning bid of $252.9 million ($771 psf ppr) topped four other competitors. TID Residential followed at $725 psf ppr, with Oriental Pacific Development ($716 psf ppr), Wee Hur Development ($705 psf ppr), and a joint venture between ABR, RP Ventures and LWH ($704 psf ppr) completing the list. Consultants had expected two to six bids, with projected land rates between $600 and $750 psf ppr.

The 30,478 sq m Senja Close site, near the Kranji Expressway, is zoned for 295 units and includes a required 500 sq m early childhood development centre for up to 100 children. It is the first EC site awarded in Bukit Panjang since 2010, when CDL’s subsidiary Grand Isle secured the land for Blossom Residences at $271 psf ppr. That project launched in 2011 and has a median price of $704 psf based on caveats lodged.

CDL Group CEO Sherman Kwek said, “We are delighted to have emerged as the top bidder for these two well-located and highly sought-after EC sites, in particular for the Woodlands Drive 17 site where our bid is 0.2 per cent over the next highest bidder.”

He added, “With the full sell-out of our recent EC projects, Lumina Grand in Bukit Batok and Copen Grand in Tengah, these two new sites—totalling over 700 units—are a timely addition to our Singapore development pipeline.”

Demand for ECs has remained strong amid limited supply. The most recent EC launch, Otto Place in the west, was secured by Hoi Hup Realty and Sunway Developments at $701 psf ppr and launched in July 2025. It sold 351 of 600 units (58.5%) at an average price of $1,700 psf under the normal payment scheme.